An easy IRA may be greatest suited for companies who don't currently keep or lead to a different employer-sponsored retirement prepare in the identical yr.

The plan is funded with contributions deducted from employees' salaries, and once-a-year employer contributions. Each qualified worker can decide if to take part and simply how much to lead, but annual employer contributions are necessary with several exceptions. To learn more, see the answer to "What do I must learn about contributions?".

If the quantity of individuals you utilize exceeds one hundred, you'll be able to still preserve your SIMPLE IRA strategy for two several years right after the first calendar year the one hundred-staff limit is exceeded.

Sixty times in advance of each and every year, employers ought to complete the Summary Description and provide this see to personnel listing the type of employer contribution that could be manufactured for that forthcoming year.

You have the choice to open your account on the internet or by mailing within an application When your employer has:

Even though, businesses may choose to match only Individuals workforce who lead or might supply a contribution to all eligible staff members. On a yearly basis, companies could swap involving match OR lead for all, if wished-for.

Your personnel have the option to open their accounts on the net or by mailing within an software. Download, print, and distribute the subsequent files to each suitable personnel who needs to apply by mail.

Bigger employer contributions also are needed if the higher limit was communicated in time. Businesses ought to make both a 4% greenback for greenback match, or perhaps a 3% non-elective contribution.

Or, immediate them to the "Get started – Staff" area underneath, which can deliver directions to enroll on-line.

Straightforward IRA options are very best suited to enterprises that hire a hundred individuals or much less, each of whom attained at the very least $five,000 through the preceding yr. This incorporates all workforce, regardless of whether or not They are really suitable to take part in click here to read your Uncomplicated IRA prepare.

In any two out of 5 consecutive yrs, you may match a smaller sized percentage, not lower than 1%. You only add to your retirement accounts of your qualified staff members who make wage deferral contributions.

This data furnished by Charles Schwab Company Here's for basic informational useful content needs only, and is not intended to be a substitute for unique individualized tax, authorized, or investment planning guidance.

one. You could possibly set a decreased minimal payment volume if you wish to allow for a lot more employees to participate.

Businesses will need to accomplish and supply a duplicate of a SIMPLE Summary Description to every eligible worker every year. Staff members should get the completed Summary Description at the very least sixty days ahead of each new calendar yr commences.

Maintain the completed primary for the data and supply a replica to each qualified staff. You'll try this annually all through Open Enrollment.

Pre-tax deferrals: Personnel income deferral contributions are made ahead of federal income tax is deducted.

A method to add to your own retirement simply and consistently, and assist your personnel add to theirs

Employer contributions should be manufactured on a yearly basis by the employer's tax filing deadline, like extensions. Staff contributions are deducted from workforce' salaries and should be deposited at the very least regular.

If you favor to open up your new account by paper application, obtain the paperwork beneath, fill them out, have a peek at this site and return them on your employer. For thoughts or help completing the SIMPLE IRA forms, Make contact with your employer or Program Administrator.

Employers will need to have furnished prior see of the higher limits to all staff at the least sixty times ahead of the close of 2024. Larger employer contributions may also be necessary if the higher limit is going to be permitted and was communicated in time.

With the matching alternative, you match the worker contribution greenback for dollar as much as 3%, to not exceed the wage deferral limit for that yr.

Ben Savage Then & Now!

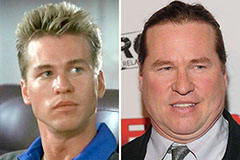

Ben Savage Then & Now! Val Kilmer Then & Now!

Val Kilmer Then & Now! Teri Hatcher Then & Now!

Teri Hatcher Then & Now! Nicki Minaj Then & Now!

Nicki Minaj Then & Now! Ricky Schroder Then & Now!

Ricky Schroder Then & Now!